Want to lower potential risk, try Dollar Cost Averaging!

by Gregory Schaffer on Dec 6, 2018

by Gregory Schaffer on Dec 6, 2018

by Gregory Schaffer on Oct 11, 2018

The Social Security Administration announced today that 63 million beneficiaries, including retirees, disabled workers and their eligible dependents and surviving family members, will receive a 2.8% increase in benefits next year, the largest annual cost-of-living adjustment since 2012.

by Gregory Schaffer on Sep 26, 2018

by Gregory Schaffer on Sep 14, 2018

It is with great pleasure to announce that The Gregory L. Schaffer Companies has been nominated for Small Business of the Year for 2018.

by Gregory Schaffer on Aug 31, 2018

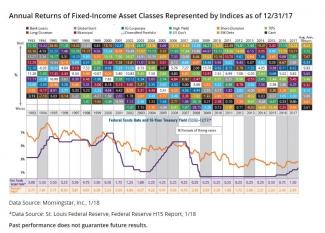

Changes in the economy and interest rates can have a big impact on your fixed-income portfolio. As interest rates rise, bond fund values become less and vice-versa. Also the longer the duration of the bond, the more volatile this concept is so in a rising interest rate environment, it is wise to keep your bond as low as possible to avoid losing principal. Your financial advisor can help you build a portfolio that’s right for you based on your goals and how much risk you’re comfortable with taking.

by Gregory Schaffer on Jun 15, 2018

I am grateful to announce another milestone in the history of The Gregory L. Schaffer Companies; our 34th anniversary.

by Gregory Schaffer on May 25, 2018

Mortgage Rates RISING!!!

Home sales are slowing, could be rising mortgage rates or low housing inventory but all asset classes have cycles and housing will in my opinion slow down with rates rising regardless.

The past week, the average 30-year fixed mortgage rate increased from 4.61% to 4.66%, the highest level since May 2011, mortgage giant Freddie Mac said Thursday. The rate is up from 3.95% at the start of the year and a recent low of 3.78% last September.

by Gregory Schaffer on Oct 31, 2017

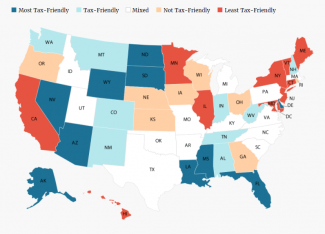

In the great quest for “making our money last in retirement”, where you live makes a substantial difference.

by Gregory Schaffer on Aug 22, 2017

According to widely used valuation metrics, the current stock market is more overvalued now than during most of the bull markets since 1900. However investors continue to maintain high exposures of risk to this very long bull market. 46% of money managers say the market is overvalued, yet the percentage who say they are overweight equities has remained unchanged. Weaker earnings in my opinion will be a catalyst to start the Bear market.