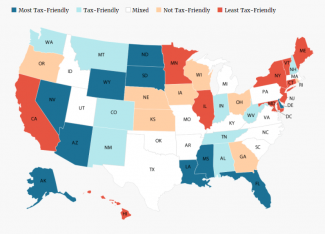

Where are the friendly states for taxes? Take a peek at the "Tax Map"

by Gregory Schaffer on Oct 31, 2017

In the great quest for “making our money last in retirement”, where you live makes a substantial difference.

Many states are not very friendly to the pocket book of our retirees and many times force those to move to tax friendly states.

When considering how to preserve and build wealth, one factor to keep in mind is that taxes impact your returns and your income along with drastically affecting your retirement.

Taxes impact investment accounts as you must pay taxes on any income, dividends and capital gains, reducing your overall returns. Taxes if not paid immediately due to a deferred tax vehicle will cost you in the future with your tax-deferred retirement accounts. When you take money out of your traditional IRA or 401(k), you must pay taxes on those distributions. So, taxes ultimately become a major factor in determining how long your retirement cash flow will last.

Take a look at the tax map for a quick snapshot of where you may consider your new tax home.